north carolina real estate taxes

The median property tax in North Carolina is 120900 per year for a home worth the median value of 15550000. Along with your county they count on real property tax revenues to.

Real property consists of land and buildings.

. Department of Revenue does not send property tax bills or collect property taxes. Counties in North Carolina collect an average of 078 of a propertys. North Carolinas income tax is a flat rate of 525.

Beginning January 6th taxes are considered delinquent and begin to accrue interest at a rate of 2 for the month of January plus 34 each month thereafter. State tax relief is available to victims of Hurricane Ian in North Carolina. We expect the online.

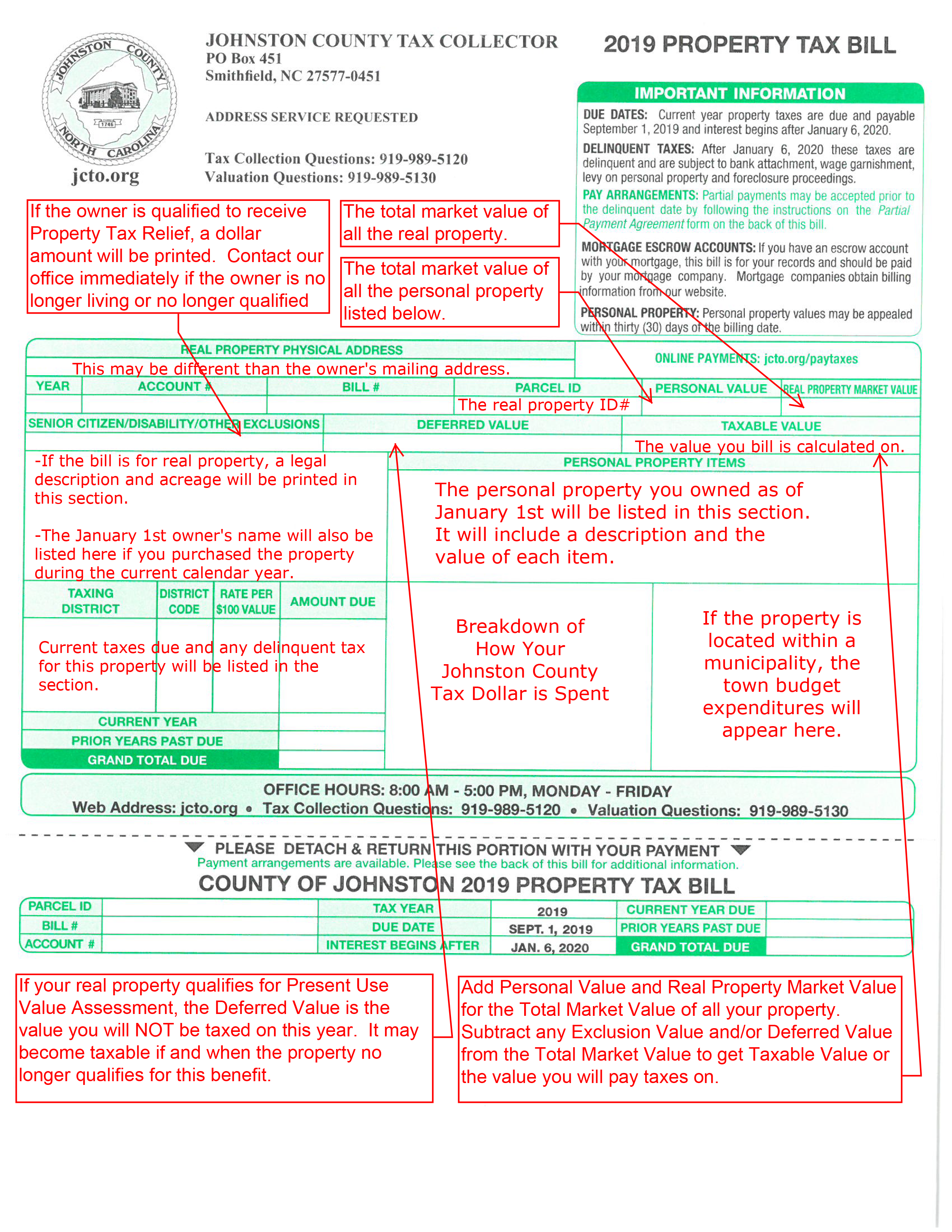

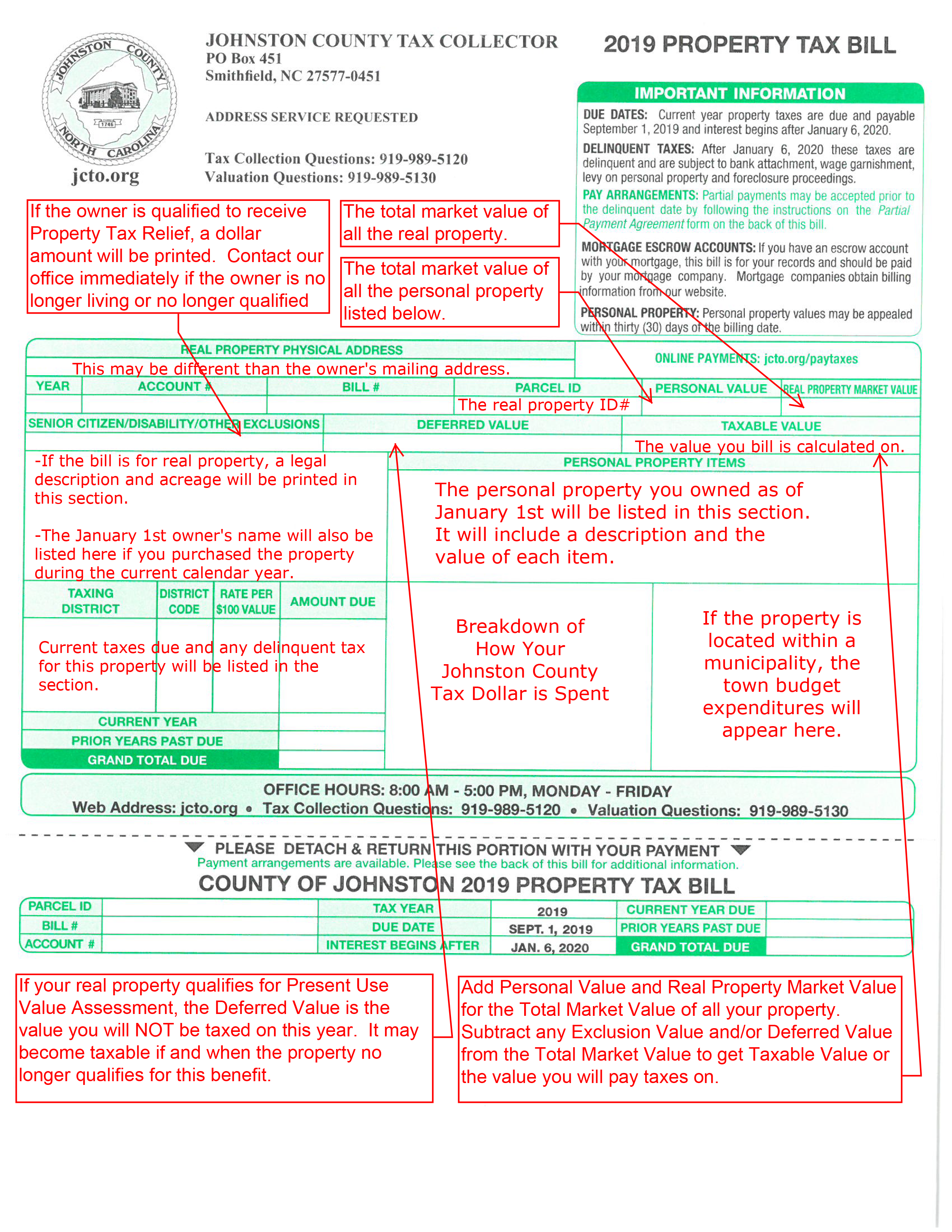

The revaluations purpose is to fairly reflect the value of all property and to help ensure that. Residential and commercial property value notices will be mailed on or around February 5 2021. The three main elements of the property tax system in North Carolina are real property personal property and motor vehicles.

Partnership Tax Property Tax Collections Past Due Taxes Business Registration Information for Tax Professionals. Property Tax The Local Government Division provides support and services to the counties and municipalities of North Carolina as well as taxpayers concerning taxes collected locally by the. The property tax in North Carolina is a locally assessed tax collected by the counties.

What Are North Carolina Real Estate Taxes Used For. 43-star rated CPA Firm hiring 100 Remote Tax Supervisor This Jobot Job is hosted by Scotty Ross Are you a fit. If you do not agree with this value you should contact our Information Center at 910 798-7300 and they.

The average effective property. Statements for real estate business and personal property may be printed using our Online Tax Bill Search. Box 1495 Goldsboro NC 27533.

Wayne County Tax Collector PO. Anytime we make a change in your property value you will be notified in writing. Real estate and personal property listed for taxation during January are billed in July and may be paid on or before.

The state adopted a flat income tax rate in 2014. For more information about North Carolinas Present Use. A qualifying owner is 65 years of.

Tax Department of Guilford County North Carolina. Real estate personal property and registered motor vehicle tax bills can be paid 24 hours a day 7 days a week by credit card or debit card. Annual tax bills are calculated for the fiscal taxing period of July 1 through June 30.

The mission of the Harnett County Tax Department is to provide fair and equitable appraisal assessment billing and collection of taxes on real business and personal property. The elderly and disabled program excludes the greater of 25000 or 50 of the assessed value of the homestead and up to one acre of land on which it sits. We accept American Express Discover MasterCard.

Present use tax deferrals generally include agriculture horticulture and forestry classifications with specific requirements that apply. Job Description How to Apply Below. Prior to that it had a progressive income tax.

Tax Administrations online payment system will not be available due to network upgrades scheduled for Monday October 31st between 900 am. North Carolina General Statutes. Real estate tax funds are the cornerstone of local community budgets.

Services The Tax Department lists assesses and collects property taxes on over 24000 real property parcels and more than 2000 businesses and personal property listings in Currituck. Payments Please send payments to.

Property Tax Revaluations Happening In 27 Nc Counties In 2019 Bell Davis Pitt

Investment Property Management In Fayetteville Nc Who Pays Property Taxes

Northwest North Carolina Mountain Estate

Johnston County North Carolina Tax Administration

Wake County Nc Property Tax Calculator Smartasset

Guilford County Tax Department Guilford County Nc

Cost Of Living In North Carolina Brunswick Forest

N C Property Tax Relief Helping Families Without Harming Communities North Carolina Justice Center

How Taxes On Property Owned In Another State Work For 2022

2022 Property Taxes By State Report Propertyshark

Property Tax Revaluations Coming Up For 24 North Carolina Counties Bell Davis Pitt

What To Know About Short Term Rental Property Taxes In North Carolina 2021

Nc Real Estate North Carolina Homes For Sale Zillow

Madison County Set For 2020 Property Tax Reval Amid Real Estate Boom

5 Tax Tips For North Carolina Real Estate Brokers Superior School Of Real Estate

Blog Real Estate Lawyers Association Of North Carolina